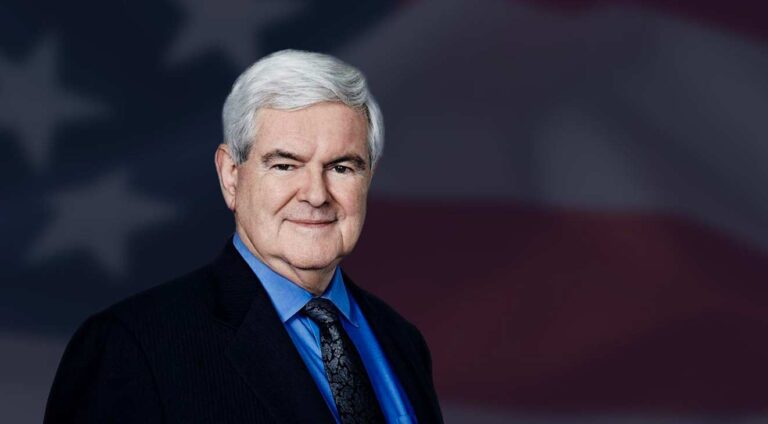

Charles Thorngren discusses the State of the Economy and the Advantages of Gold Investment with Speaker Newt Gingrich.

In a broad and eye-opening conversation with New Gingrich on Gingrich 360, Charles Thorngren, CEO of Legacy Precious Metals, talked about the challenging state of the US economy and what Americans can do to preserve their wealth and protect their retirement and savings.

Mr. Gingrich and Mr. Thorngren zeroed in on these trying economic times. The United States is suffering from supply chain challenges, soaring gas and oil prices, and an unprecedented inflation rate of 8%. Many of whom have not received an 8% increase in salary, Americans are paying more for less.

In a highly surprising takeaway, Mr. Thornrgren revealed he believed the government’s estimate of an 8% inflation rate was much lower than his reckoning of 16%.

While Americans understand that some of the prices paid at the gas pump can be attributed to the Russia-Ukraine war, there is often sticker shock at the grocery store. Mr. Gingrich and Mr. Thorngren pointed to US sanctions on Russia. The US imports 22% of nitrogen complex fertilizer, an essential plant nutrient used by farmers for growing. Russia accounts for 15% of worldwide trade in this type of fertilizer. The price of fertilizers has risen almost 300%. As sanctions have been heaped on Russia, access to this fertilizer is diminishing, leading to a price hike in the vegetable and fruit aisle.

Nearly every business sector has been impacted by inflation, supply chain logger jams, and the challenge of finding workers. The increase in cost to do business is being passed on to the consumer and becoming a vicious cycle.

To break the inflation cycle, the Fed is raising interest rates making it more expensive to borrow money. The thought is that if it costs more to access cash, the scale will tip in favor of the consumer, lowering the cost and raising the availability of products. However, it is a mistake to believe that this will automatically translate into lower prices. Mr. Thorngren also pointed to the stock market, which often takes a hit when interest rates go up, and interest rates are projected to increase an additional six times this year, leveling out at 6% in 2023.

Wall Street reacts to all aspects of the country’s financial health. The US budget and debt of trillions of dollars put all American and their wallets in a precarious position. Mr. Gingrich discussed how Congress finally balanced the budget when he was the speaker. In February of 2022, the US Treasury reported that the US had surpassed 30 trillion dollars in national debt. This alone can have wreak havoc on the market and income taxes.

With everything costing more and a skittish stock market unnerving investors, it is understandable that Americans are feeling insecure. The former speaker and Mr. Thorngren mentioned options which include asset diversification. Gold plays a critical role in asset diversification and is considered a safe-haven investment.

The two men took a deep dive into the role gold has played as a hedge, types of precious metals, and investment opportunities in the sector. Topics include the Great Recession of 2008, gold versus silver, and tax implications potential precious metal investors should consider.

The Great Recession of 2008

Amidst the devastation of 2008, companies that were too big to fail simply did, and they folded very fast. It took years for the market to regain momentum and, worse, for investors to recoup their losses. Individuals who included metals in their portfolios were protected somewhat against this devastating financial crisis. Metals counterbalanced the effect of a plunging equities market. The value of gold skyrocketed. Gold soared from $849 a troy ounce to $1896.50.

Gold Versus Silver

Mr. Thorngrens company, Legacy Precious Metals, markets four types of precious metals: gold, silver, platinum, and palladium. Only gold and silver have a currency aspect. Platinum and palladium have a more industrial association. When it comes to investing in gold or silver, there are several considerations. Both metals are finite and used for jewelry making and manufacturing, such as semiconductors (gold). The investment decision may simply come down to storage. Investors may opt to store their metals on their premises, and if there is a significant transaction in silver, then the investor would need to make sure they have a safe location to store it. As a more expensive metal, gold bullion requires less room for safekeeping.

IRA Versus Bullion

There are several ways to purchase precious metals. It all depends on the investor’s needs, says Mr.Thorngren. An existing IRA can be rolled over into a new gold IRA, which will avoid tax and early withdrawal penalties. If the investment is coming from another source, cash, or liquidating an existing asset, a discussion with an experienced gold dealer is crucial for optimal decision making.

Gold Versus the Stock Market

Wealth managers and brokers often refer to profits in the market in terms of “returns.” Your portfolio may be lower than the returns across the board because not all portfolios are identical. It depends on how your portfolio was built. Returns on metals are based on metal price, not types of metal investments you own.

Short Term Versus Long Term

Mr. Thorngren told Mr.Gingrich that youth is advantageous when purchasing precious metals. Even investing the smallest amount makes sense. There is no sales tax on more than $1,500 as it is considered a physical item rather than an investment.

Personal Considerations

Investors struggle with how to invest in metals and how much to invest in metals. It all begins with selecting a trustworthy dealer who will guide you through the process and help you determine your goals. In addition to purchasing, bullion investors may decide that gold or silver coins may be a better choice. Companies like Legacy Precious Metals offer personal guidance, education, and fair pricing, so their clients can feel confident about their decision-making process.

“It is all about creating robust opportunities for our investors.” says Mr. Thorngren,” because the stronger the individual, the stronger the country.” Individuals with diversified investment portfolios are positioned to ride out a challenging economy and rest easier at night.

Listen to this riveting interview below, or click here https://www.gingrich360.com/2022/03/24/newts-world-episode-389-the-economy-investing. To learn more about investing in precious metals, visit https://legacypminvestments.com